In this edition of Critical Thinking, Peter Hütte unpacks the US government’s increasing treatment of critical minerals as levers of national security.

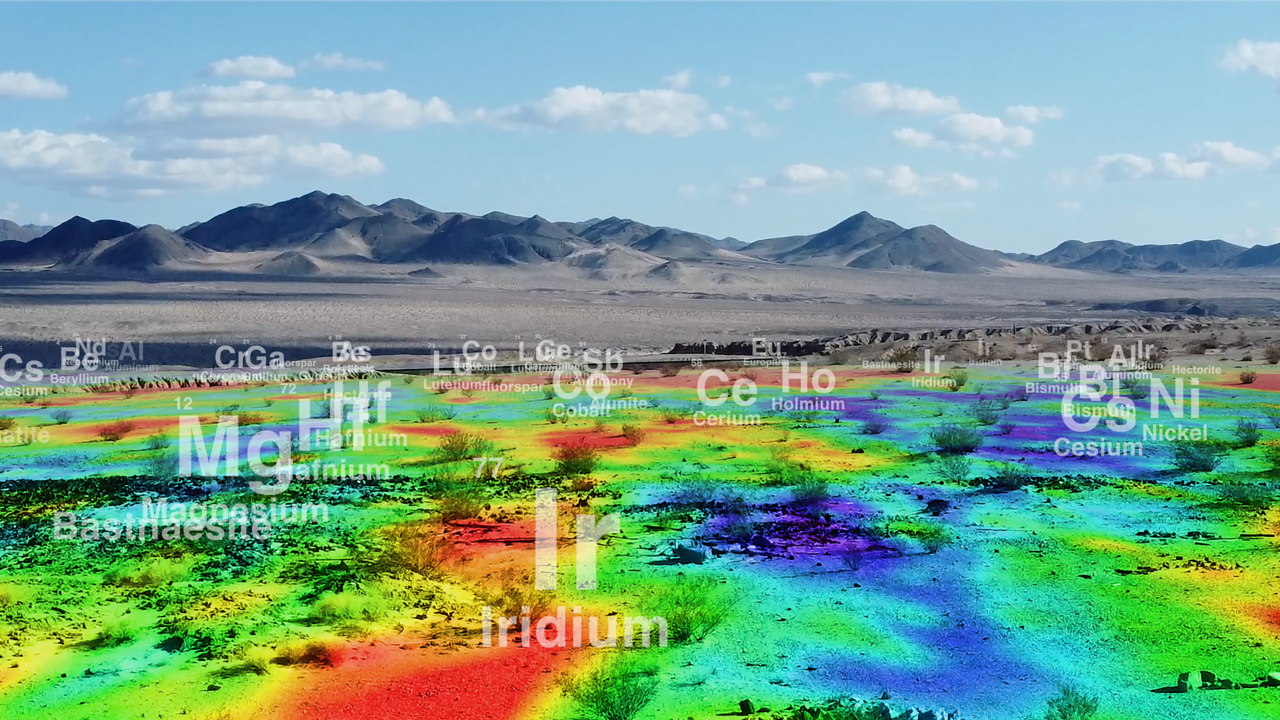

Critical minerals are quickly becoming a central driver of US foreign policy. What started in April with a transactional minerals-for-support arrangement with Ukraine has become a defining feature of Washington’s playbook – one that sees minerals as national security assets rather than mere industrial inputs. This is yet another example of “The National Securitization of Everything,” a theme that Veracity’s CEO, Benjamin Weiss, has written and spoken about, and that we are increasingly seeing in our client work on mining, energy, and digital infrastructure matters.

The US is progressively orienting its foreign policy toward securing long-term access to the materials that underpin the country’s economy, with the Trump administration favoring bilateral deals over multilateral agreements.

Secretary of State Marco Rubio has described this new approach as “trade over aid, opportunity over dependency, and investment over assistance.” The State Department is now directing its posts to adopt a more commercial role – facilitating resource investment, supporting US project sponsors in critical minerals and, in Africa, evaluating diplomats in part on the deal activity they generate. This year, the United States has signed a range of agreements that reveal both the ambition of the strategy and the limits imposed by local conditions.

At first, the US-Ukraine agreement appeared largely symbolic, given wartime conditions and limited modern geological data. Seven months later, a joint US$150 million fund has been activated through matching commitments from the DFC and the Ukrainian government, and preliminary work is underway to modernize Ukraine’s geological foundation. But progress remains modest. Due to security conditions and institutional constraints, operations do not yet match the vision.

The minerals deal with the Democratic Republic of Congo in June 2025 followed a similar model on paper – market access to minerals in exchange for increased US investment and political backing – but has not advanced in practice. The commitments remain broad, financing tools are undefined, and political and security dynamics have stalled follow-through. As of today, the partnership has not moved beyond its announcement, underscoring how difficult it is to translate minerals frameworks into action in fragile and contested environments.

By contrast, the frameworks signed with Australia and Japan in October represent a clear change. The Australia agreement includes a firm pledge by the Australian and US governments to deploy US$1 billion each within six months to advance strategically significant mineral projects. The framework with Japan does not include a matching monetary commitment but establishes the same six-month timeline to identify and finance selected ventures. Japan’s Ministry of Economy, Trade, and Industry also released a list of mining, energy, AI, and related projects during the meeting between President Trump and Prime Minister Takaichi, which the two governments committed to develop jointly.

Both frameworks rely on a wide set of policy tools: price support mechanisms, streamlined permitting, geological mapping, recycling initiatives, coordinated stockpiling, and investment screening to limit Chinese acquisition of strategic assets. By drawing on Australia’s mining expertise and Japan’s processing and manufacturing capabilities, the three countries are well positioned to translate these frameworks into concrete outcomes.

MOUs with Malaysia and Thailand signed in October show the same directional shift but at an earlier stage. They center on knowledge exchange, capacity building, and investor outreach, broadening Washington’s partnerships while underscoring the limited industrial base in both countries.

Taken together, the number of agreements show that critical minerals have become a formal lever of US diplomacy and industrial strategy, although the impact of these agreements will depend heavily on the industrial base of partner countries. Future frameworks with mature producers and processors – such as Canada or South Korea – stand the greatest chance of translating policy tools into real projects. Newer entrants will move more slowly, even as the urgency of reducing Chinese concentration in critical minerals grows.

As the United States deepens coordination with capable allies and expands the use of public capital, the boundary between commercial decision-making and government priorities will continue to narrow. Veracity will track how these dynamics evolve and what they mean for firms operating across minerals supply chains.